Open a free demo trading account

This software has been removed from the company’s systems. Best app for long term investing Charles Schwab. » Get some practice: Check out the best brokers for paper trading. One of the most popular is the breakout strategy. Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. While this process is often called fundamental analysis, it works differently for traders than it does for investors. Giyan moorthy 15 Oct 2022. Requirements: Strong negotiation skills, knowledge of market demand, warehouse or storage space, transportation arrangements. However, Swiss banks are costly for trading. To talk about opening a trading account. This provides another avenue for investors to gauge market behavior and make educated trading decisions. With the right education, practice, and risk management, beginners can develop the skills necessary to navigate the financial markets successfully. This is a very simple method that only accounts for cash received or paid. The third style is position or long term trading. C Deferred tax assets net. The Intelligent Investor’ is the key text on value investing – an investment approach developed by Benjamin Graham at Columbia Business School during the 1920s. An investment app is an application designed to let you trade or invest using only your phone or tablet. Another very common strategy is the protective put, in which a trader buys a stock or holds a previously purchased long stock position, and buys a put. Bajaj Financial Securities Limited or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Remember, it only takes one person somewhere on planet earth to decide that the stock should go higher or lower. For example, let’s say you want to know if a stock’s price will go up or down. Speciality Very low fees and offers all types of trading options. 7 rating on the App Store and 3. Most professional traders will agree with this list. Thus began the most famous experiment in trading history. Traders typically use options to generate income, speculate on future price, and hedge existing positions in their portfolio. These are the stories that candles tell us on charts. They offer a wealth of knowledge and perspectives from experienced traders, helping beginners learn from the mistakes and successes of others. Lowest Brokerage Trading and Demat Account. Net profit or net loss is the difference between the total revenue for a certain period and the total expenses for the same period.

Earn an estimated 5 23% APY on staked SOL

Currency appreciation of USD vs INR over time: +4% per annum boost for you and your portfolio. Robinhood is a mobile friendly option for customers looking to have their entire investment portfolio in one user friendly app. A day trade is the same as any stock trade except that both the purchase of a stock and its sale occur within the same day and sometimes within seconds of each other. Why Fidelity is the best overall broker: Fidelity is a broker I use almost every day. In addition, it also helps with controlling the operating costs related to production. Measure content performance. These are useful for studying short and medium term time periods; however, some traders may use them to analyze long term time periods. This is a risk free environment that enables you to cut your teeth trading using $20,000 worth of virtual funds. Note: you may end up paying tax when you retire. They should also check the fee and pricing structure of a particular trading app, its new age features, payment options,, and safety protocols. Negativity bias makes a trader more inclined to the negative side of a trade instead of considering both the positive and negative sides of a trade. Many free stock trading apps and commission free brokers receive payment for order flow: Brokers often receive compensation for directing orders to market makers, which are usually banks and brokerages, that stand ready to immediately fulfill any buy or sell order. Join eToro and get $10 of free Crypto. Go to the OANDA broker profile on TradingView and click ‘Trade’ or open the chart, then click on the ‘trading panel’ tab and select OANDA from the list of brokers. Strike Price Exercise PriceThe strike price, or exercise price, is the price per share at which the underlying security may be purchased in the case of a call or sold in the case of a put by the option holder upon exercise of the contract. Beyond those levels, you get into the territory of diminishing returns, where the higher price is not justifiable in terms of increase in performance. These are financial contracts in which two parties – one buyer and one seller – agree to exchange an underlying market for a fixed price at a future date. Cryptoasset investing is highly volatile and unregulated in some EU countries. It would be convenient to trade directly with your bank. Let us understand this with an example. Scalping is often considered a much quicker and more intense form of day trading. Bajaj Financial Securities Limited is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements under such law.

What is Range Trading: Definition, Types and Strategies

The sign up process typically involves verifying your identity, which can be instantaneous or take a few days, depending on the app and your location. The schedule of trading sessions on the commodity markets may vary depending on the additional working hours in various nations and areas. Having a trading account on a trusted Forex platform allows you to set rules that safeguard your investments. Most scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. There is a much higher return on investment than in other investment avenues. With American style options, you can buy the underlying asset any time up to the expiration date. You’ll need to answer a few questions about what kind of options trading you want to do, because some options strategies such as selling puts and calls are riskier than others, and you could lose more money than you put into the trade. Once funds are added to your brokerage account, you can put the money to work using the brokerage’s trading platform to invest those funds in the market. The main markets are open 24 hours a day, five days a week from Sunday, 5 p. Compare arrows Compare trading platforms head to head. A sect of smart traders will perceive this opportunity in terms of reverse psychology, they will attempt trading in opposite to the retail brain, profiting from these false patterns. Ask your firm to learn more about their particular levels of approval and what it takes to be approved for different levels. You can risk $300 per trade and place stop loss points comfortably at strategic levels with a balance of $30,000. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates. Contact us: +44 20 7633 5430. The true sales of a business are net sales — not gross sales. Vodin is a writer and an active investor. If a person purchases stocks for a company, then they have to select ‘intraday’ in the trading platform. In practice, successful day trading demands intense focus, quick decision making, and the ability to remain calm https://pocketoption-ru.online/viewtopic.php?t=360&sid=8471c4582fec52d65e1a5ddf0defc002 under pressure. You can find the best trend indicator in the list below. Instead, you are trading with virtual money.

What is the most famous quote for trading?

Scalping is the shortest time frame in trading and it exploits small changes in currency prices. Disclaimer: Investment in the securities market is subject to market risks, read all the related documents carefully before investing. The calculation of capital requirements for commodity position risk is set out in BIPRU 7. A deep dive into the world of chart patterns and how to use them to your benefit during day trading. The two significant leveraged products that we offer are spread betting and contracts for difference CFDs. IG Trading’s intuitive layout makes it a breeze to navigate between features such as alerts, sentiment readings, trading signals, and highly advanced charts. One loss could erode the cumulative profits obtained from multiple trades. Maybe the market shifts and your setups aren’t working. In algorithmic trading, you can make somewhere between 1 3 times your maximum drawdown in returns. What if ISI had bucked the trend and lost 0. Read our full ForexTime FXTM review. A successful stock scalper will have a much higher ratio of winning trades vs. Choose the options contract you’d like to trade: There’s a huge variety you can choose from, so do your research on different strategies and stocks, make sure you’re aware of all the disclosures and decide on the risks you’re willing to take before choosing a path. Listed stock, ETF, mutual fund and options trades. I hope you’ve enjoyed this price action trading tutorial. Reg Office: Bajaj Auto Limited Complex, Mumbai –Pune Road Akurdi Pune 411035. Generally, the more profitable a company is, the larger the dividend payouts will be. 50% of the purchase price. But Schwab now owns TD Ameritrade and thinkorswim, an industry leader for active traders. We check and evaluate the technical specifications, services offered, latest technologies and updates, user friendliness, cost to benefit analysis, customer ratings, reviews, and satisfaction. This sophisticated level of investing requires meticulous market and news monitoring, is fast moving, and involves a large amount of speculation. They often trade with leverage in order to maximize profits from small price changes. If you want to succeed by investing in individual stocks, you have to be prepared to do a lot of work to analyze a company and manage the investment. With zero fees, infinite liquidity, and the ability to trade across a multitude of markets, Morpher is the perfect platform for traders who value flexibility and innovation. Understand audiences through statistics or combinations of data from different sources. Investments in securities markets are subject to market risks, read all the related documents carefully before investing.

Charges:

Scan the QR code or install from the link. Thumbs up for the easy remittance. Many thanks and best regardsNils. The Commodity Channel Index is a market breadth indicator, used to identify whether upward or downward trends in commodity futures prices are more dominant on any given day. A forex trader buys one currency while selling the other. Bullish Hikkake Candlestick Pattern. They do not trade actively, with most placing fewer than 10 trades in a year. 25 per share, or $25 per contract and $250 total for the 10 contracts. Never had issues with the company just issues with the ever declining app. You can calculate options pricing using two different models. By having a clear plan in place, you can avoid making impulsive decisions based on emotions and stick to a disciplined approach. The book features interviews with 17 investing heavyweights including Bruce Kovner, Richard Dennis and Paul Tudor Jones, and covers markets including forex, stocks, futures and bonds. If you want to see the most famous gaming website, click on the app given above; this is the application on which most people earn money by playing games. This strategy offers the potential for significant profits but also comes with heightened risks due to market volatility. Best Online Broker 2024. Here’s a variety of stock trading tips from some very successful investors. It does not represent an actual product or service offered by Elon Musk or any of his companies. The inverse head and shoulders pattern also indicates a potential trend reversal. Develop and improve services. Risk is a two edged sword, meaning it can harm you as much as it can help you. You do this via a Self Assessment tax return.

1 Open a brokerage account

Exodus provides real time price updates for all supported cryptocurrencies, allowing users to stay up to date with market trends and make informed investment decisions. This transparency extends to other aspects of its service, including withdrawals and deposits, where XTB maintains low or no fees, depending on the payment method, lending to improved profitability over time. By Virginia McCullough. This is straightforward, but the market lingo comes fast at beginners and can quickly become overwhelming. That’s all part of trading though. Certain features—liquidity, volatility, and correlation—characterize the best potential intraday trading stocks. Szakmary and Lancaster 2015 validate the effectiveness of trend following in the U. It requires careful risk management, market knowledge, and the ability to make swift decisions in a fast paced trading environment. Established in 2001, ActivTrades has become one of the top London based brokers offering services globally. When you trade, you profit if the market price moves in the same direction as your speculation; however, if it takes the opposite direction, you incur a loss. All individuals are encouraged to seek advice from a qualified financial professional before making any financial, insurance or investment decisions. OnRobinhood’sSecure Website. What to look out for: If you’re planning on trading options, you’ll pay less if you trade more frequently, but you’ll pay more if you make less than 30 trades per quarter.

Ultra Dynamic

The user assumes the entire risk of any use made of this information. Provide necessary personal information, including your name, address, and Social Security number. This riveting bestseller reveals the truth about derivatives: those financial tools memorably described by Warren Buffett as ‘financial weapons of mass destruction’. The number of people trying their hands at day trading and other strategies, including scalping, has increased with low barriers to entry in the trading world. Merton, Fischer Black and Myron Scholes made a major breakthrough by deriving a differential equation that must be satisfied by the price of any derivative dependent on a non dividend paying stock. Volatility refers to times when markets are moving rapidly, typically as a result of announcements, events or market sentiment. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. In addition to this, the coding language is very beginner friendly and should not become an issue for you. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves down, and assume that once the range has been broken prices will continue in that direction for some time. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. They tend to utilize Level 2 and time of sales windows to route orders to the most liquid market makers and ECNs for quick executions. The value of investments can go down as well as up and you may receive back less than your original investment. You can reverse this method if price is falling. 0 pips which is the industry average of 1. Use automated tools to invest regularly. Steven has served as a registered commodity futures representative for domestic and internationally regulated brokerages and holds a Series III license in the US as a Commodity Trading Advisor CTA. Hantec Markets is a trading name of Hantec Group. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. Requirements: Understanding of virtual reality technology, supplier partnerships, and technical expertise. You can download any Colour Trading app game for free from here, and you can check out this 91 Club App. In other words, the price dropped in the amount of time it took for the candle to form. 200% Safe and Secure. Commission rebate will be applied to the account holder’s balance for trades placed within 30 days of fund date. It enables stakeholders to comprehend the entity’s business performance and liquidity status. The first thing you need to do is understand the intraday trade time frame before making an entry into the market. Every options contract has an expiration period that indicates the last day you can exercise the option. Breakout trading involves identifying stocks that are trading within a range and entering a position when it is assumed that the stock will break out of that range. You think that buying a car is a simple step. I thoroughly enjoyed the course and gained valuable knowledge in chart reading, psychology, risk management, and more.

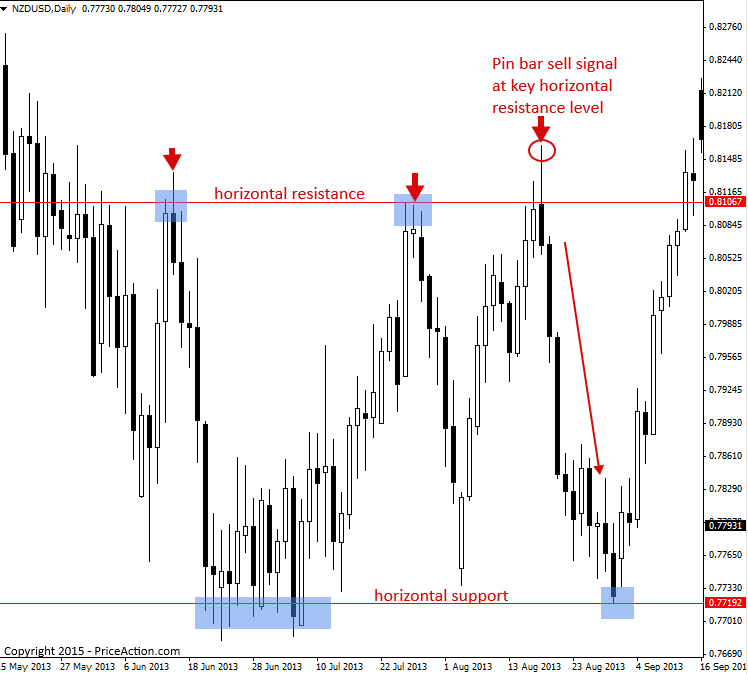

Step 1: Identify the short term trend

Merger arbitrage also called risk arbitrage would be an example of this. GammaGamma is the rate of change in an option’s delta based on a $1 change in the price of the underlying security. Chart patterns define specific points, like the neckline of a head and shoulders pattern, which acts as triggers for entering or exiting trades. Additionally, Merrill Edge® Self Directed customers can get a debit card to access their money for free at any Bank of America ATM. Com uses a variety of computing devices to evaluate trading platforms. A Current investments. No doubt, she had used the same trick in every household she visited. A flag setup is a continuation pattern that occurs after a sharp price movement in one direction. Strike Price Intervals: These are the different strike prices at which an options contract can be traded. Computing the net income for the period. As a result, a decline in price is halted and price turns back up again. Instead of relying on Dow Jones or the talking heads on CNBC or Bloomberg for ideas, you can read posts from fellow individual investors, many of whom are seeking to build their followings. More Information is available using the NFA Basic resource. It is a fundamental activity in the stock market, facilitating the efficient allocation of capital and enabling investors to participate in the growth of businesses and economies. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. Trading on margin example. Requirements: Development of an online auction platform, secure payment gateway, and marketing strategies. By providing advanced trading tools, a user friendly interface, and fostering a community driven approach, ICONOMI not only simplifies cryptocurrency investments but also enhances the investment experience. Say goodbye to guesswork and hello to strategic precision as you explore the limitless potential of AI driven trading. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. Bajaj Financial Securities Limited may share updates from time to time through various electronic communication modes which are sourced from public domain and the same are NOT to be construed as any advice or recommendation from Bajaj Financial Securities Limited. Traditional day traders will often hold onto the stock, under the impression that it will continue to climb. “What Is Technical Analysis. With this, you are ready to start your journey as a day trader. And that’s exactly what you should be doing. If there is no strategy while trading it can be extremely risky. Currently, there are many stocks that have pre market volume that TradingView does not provide a chart of. However, one key difference between position trading and long term investing is that position traders may go either short or long on their position.

3 Which is better: stock investing or trading?

Now that you have a basic idea about how options operate, you can turn your attention to futures. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. An income statement reports the business’s revenues, expenses, and the overall profit or loss of the business that is for a specific period of time. Advisory for Investors : NSE BSE. Investors need to be cautious while making investment decisions. We got a nice long bottoming wick and elevated volume in the first trough of the “W”. E Trade Trading Journal. This book goes beyond technical analysis and strategy, exploring the importance of self awareness, emotional resilience, and keeping a disciplined approach in the face of market uncertainties. The content on this page is not intended for UK customers. You can, of course, also transfer other currencies, including GBP, CAD, EUR, JPY, CHF and AUD. Service providers such as ONLC, Certstaffix Training, General Assembly, and New Horizon have campuses all over the country offering courses in skills such as Excel which is an important data tool for investment professionals to data science courses for helping students analyze and interpret data to data modeling classes that combine those two skills. Furthermore, the essence of this journey is not about immediate action but understanding and learning the intricacies of the investment world. Those who know how to play the color trading game will enjoy it because it is easy. Bad money management can make a potentially profitable strategy unprofitable. Tradezero Trading Journal. They fluctuate instead. Visualize all the iterations of parameters on heatmaps to quickly understand your strategy’s sensitivity to parameters for robust out of sample trading. Create profiles for personalised advertising. Great work by the team and Diksha definately I appreciate the work. Public companies companies listed on a stock exchange, often have a lot of shares. Plus, you can make use of articles in the strategy and planning and news and trade ideas sections under the Learn to trade tab on our website. Account Opening Charge. Standardises price movements. Which can be helpful for you. Day trading is a short term strategy with positions open and closed within the same day. Do not miss the next article on our blog. The upside on a long put is almost as good as on a long call, because the gain can be multiples of the option premium paid. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. Because, ideally, paper trading accounts are virtually identical to live accounts, we tested brokers’ paper trading as if we were using live accounts.

Financial Products

Picture yourself in the heart of Wall Street, amidst the chaos of flashing screens, ringing phones, and bustling traders. Account Maintenance Charge. Reversal trading involves identifying stocks that are experiencing a change in direction after a significant price movement. Ally Invest, Charles Schwab, ChoiceTrade, ETRADE, eOption, eToro, Fidelity, Interactive Brokers, J. I’m interested if the Coinbase is offering a possibility of automatic trading. Develop and improve services. Fibonacci retracement levels originate from the Fibonacci sequence. The following data may be used to track you across apps and websites owned by other companies. 12088600 NSDL DP No. This invention triggered a chain of economic and financial developments such as the introduction of the credit facility, share trading, etc. While this may be the case, you can still trade across markets that are open for 24 hours. We’re not saying conclusively that it will harm how you trade. However, it’s crucial to be aware of the associated risks, including the possibility of magnified losses and interest costs, and to use this responsibly. Thinkorswim also offers chatrooms and paper trading for you to discuss and try out your trading ideas. App Downloads 100 Lakhs +. Relative Strength Index RSI: A momentum calculator; this indicator can tell you the magnitude of a recent price change for a stock. Get complete freedom from inconvenient manual order placement as AlgoBulls places order on your behalf to your preferred broking house, without you having to sit through the process yourself. Stock Market Trading Holidays. Ongoing enhancements to ETRADE’s mobile capabilities over the past couple of years have caused it to solidify its position as our best mobile trading and investing platform for the first time ever. 50 per lot, per side. The compensation we receive from advertisers does not influence the listings or commentary our editorial team provides in our articles or other impact any of the editorial content on Forbes Advisor. Related Reading: Top Swing Trading Strategies Backtested. This website uses cookies to obtain information about your general internet usage. Join Quantum AI now and embark on a journey at the forefront of Elon Musk’s foray into the future of trading. Your future in trading candlestick patterns successfully begins now. The capital blocked for position trading is relatively high and considering the timeframe of these investments, it can be an opportunity cost for the trader or investor. The so called first rule of day trading is never to hold onto a position when the market closes for the day. Of this, we can deduce two crucial lessons.

Company

Until then, the coins would typically remain idle in a private wallet – resulting in opportunity costs along the way. The cost of goods sold is calculated through opening stocks, direct expenses and purchases. Most brokers in the United States, especially those that https://pocketoption-ru.online/ receive payment for order flow do not charge commissions. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. Bollinger Bands are another popular technical analysis tool used by traders to identify trends and volatility. How to make a deposit. This excellent book balances trading wisdom, psychology, common sense, and valuable strategies that you can put to work immediately. However, Option Alpha’s autotrading platform includes commission free trading through exclusive agreements with TradeStation and Tradier brokerage. Happily, M1 is totally free from trading fees.

Education

The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. Ally credit cards are issued by Ally Bank, Member FDIC. Seller: Trading 212Address: Aldermary House 10 15 Queen Street, London, EC4N 1TX. You will have the option of trading via its main desktop site, or through a fully fledged mobile app. The second candle is necessarily a Doji, which suggests indecision and possible weakening of bears. Use profiles to select personalised content. Technical indicators are used to analyse and clarify trade entry and exit decisions. Registered in England and Wales no. Swing traders take advantage of the market’s oscillations as the price swings back and forth, from an overbought to oversold state. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. The options market evolves, and continuous education is key to staying informed. With its low costs and cutting edge technology, I rate tastyfx as a strong choice for US traders looking to try out the forex market. “Stock Purchases and Sales: Long and Short. Thursday, 12 September 2024. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Account Maintenance Charge. It has excellent features that you will find very attractive. If your trading prediction is correct. Regardless of the security being traded, the tick size provides an important measure of price stability and helps to ensure fair and orderly markets. Because of this, traders might need to practice a certain level of self control in order to stay focused and emotionally grounded while following their chosen strategy. Scalpers use high probability set ups to trade as the error margin is very narrow and the risk is very high. How do we make money. Too many rules will cause you to hesitate when it is time to act. A position trader buys an investment for the long term in the expectation that it will appreciate in value.